Some people may choose to remain anonymous in significant financial transactions, whether it be real estate, investments and more. As countries look to prevent money laundering and other financial crimes, disclosing beneficial ownership is fundamental for ensuring the legality and stability of the financial system. How does this work in a system where street names are often the norm? Here’s a closer look at the definition and the rules.

What is beneficial ownership?

The Financial Action Task Force is the global authority set up in 1989 to create a set of international standards and foster the promotion of “…effective implementation of legal, regulatory and operational measures for combating money laundering, terrorist financing and other related threats to the integrity of the international financial system.” Part of the FATF’s work includes creating a set of international standards that are applied across member states and other jurisdictions. This set of standards includes the definition of beneficial ownership, which is pivotal for fulfilling their mission as a policy-making organization. The FATF’s definition of beneficial ownership is that:

Beneficial owner refers to the natural person(s) who ultimately owns or controls a customer and/or the natural person on whose behalf a transaction is being conducted. It also includes those persons who exercise ultimate effective control over a legal person or arrangement.

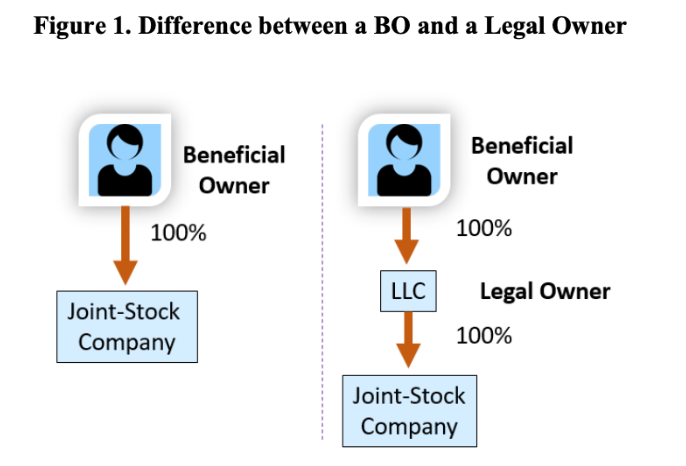

What makes the FATF’s definition of beneficial ownership so important? It moves into the territory of ultimate beneficial control. As we saw above, ultimate beneficial ownership means that it refers to the person who owns and takes control of the assets or capital. Another reason why the FATF is pivotal is because of standard practices in the investment sphere. If a broker holds securities in a street name, or a custodian bank holds mutual fund shares, the beneficial owner is the true owner of those securities or mutual fund shares. The broker or banker may hold the title for matters of convenience and safety even if they are not the ones who are the real beneficiaries and have control over the assets. Beneficial ownership is not strictly limited to securities and assets. A toolkit from the Organization for Economic Cooperation and Development (OECD) and Inter-American Development Bank (IDB) notes that “[b]eneficial owners are always natural persons who ultimately own or control a legal entity or arrangement, such as a company, a trust, a foundation, etc.” Another point to remember is that a beneficial owner and legal owner are not always the same. How? The toolkit from the OECD and IDB uses an example that illustrates this distinction.

Source

If there’s another layer (an LLC) in between the beneficial owner and the entity (which in this example is the joint-stock company) the beneficial owner is just the beneficial owner, while the LLC is the legal owner of the joint-stock company.

What is the definition of beneficial ownership in the UK?

While the United Kingdom, along with the United States and the European Commission, is a member state of the FATF, it has its own definition of beneficial ownership for regulatory purposes. It “refers to the person or persons who ultimately own or control an asset (for example, a property or a company) and benefit from it.

Ultimate beneficial ownership regulations

The regulations for ultimate beneficial ownership depend on the country, and their reporting measures differ as well. For example, the United States Securities and Exchange Commission (SEC) requires a beneficial owner who owns at least 5% of a publicly-traded entity to file Schedule 13D, also known as a beneficial ownership report, within ten days of the acquisition of that percentage under the Securities Exchange Act of 1934.

In contrast, privately-held British companies and limited liability partnerships (LLPs) have to file an ultimate beneficial ownership declaration. They do this by submitting the following information to the People with Significant Control (PSC) register: name, month and year they were born, details of interest in the company and their nationality. This law went into effect on June 30th, 2016 and lists people who meet one of four requirements. They can appoint or remove the majority of the board of directors, have at least 25% of voting rights or shares in a corporation or have another means to exert a significant amount of control over the entity. The information is made freely available to the public and must be filed as part of the annual reporting to Companies House. There are also public registers for trusts and properties and land.

The UK broadened the legislation establishing the PSC register due to the implementation of the 4th Anti-Money Laundering Directive in the European Union. This directive required EU countries to set up ultimate beneficial owner (UBO) registries of legal entities. The final implementation was left to each state, so the enforcement differs across countries. The British bodies having to comply are “…all UK incorporated companies limited by shares (with the exception of companies listed on a European Economic Area (EEA) regulated stock market), companies limited by guarantee, unlimited companies, limited liability partnerships and societas Europaea.”

Another benefit of the United Kingdom creating this register is that they help prevent people from hiding assets and the income they either received through illicit means or need to pay tax. They also help stop crimes such as money laundering, tax evasion and corruption. It makes it easy for a compliance officer to confirm information if they suspect the ultimate beneficial ownership of an asset. The example cited in the House of Commons working paper explicitly refers to an anonymous offshore trust, meaning that this information is of great interest to the authorities. Should a company not apply with the PSC compliance measures, the entity can freeze the person with significant control’s interest in the corporation.

How to calculate ultimate beneficial ownership

Are you looking for the best way to determine and calculate ultimate beneficial ownership among the controlling stakeholders in your entity? Our experienced team of Wealth Management and Private Banking specialists will analyse your portfolio to ensure you meet full compliance with the ultimate beneficial ownership requirements in your home country. Full legal compliance is one of our hallmarks, and we provide our clients with the tools to craft the framework to build their wealth over generations while remaining in the good graces of the authorities. If you would like to get started, contact our Wealth Management and Private Banking team today.

Written by

Hiba Malik

Legal Executive – Quality Services Management Division