FATCA vs. CRS: Comparing Financial Reporting Standards

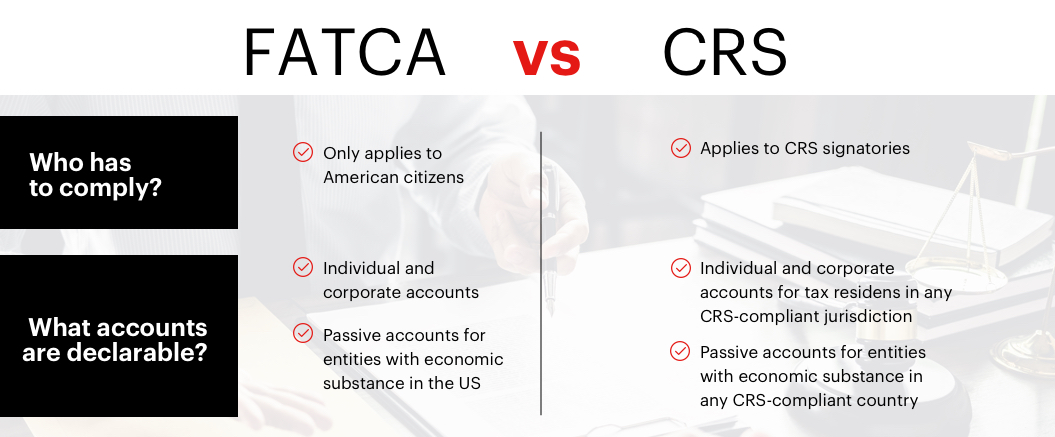

When you have a business operating in multiple locations around the globe, compliance is one of the components to consider when deciding where to operate. There are two systems, FATCA and CRS, that could impact your company’s status because they require financial institutions to provide information about their customers to ensure they fulfil their tax obligations. What do you need to take into account? Here’s some guidance to ensure you carry out proper FATCA/CRS compliance.

But first, what is FATCA and CRS?

FATCA

FATCA, the abbreviation for the Foreign Account Tax Compliance Act, is a piece of US legislation signed into law in 2010 that required American citizens to file annual reports for any accounts abroad. The Act was part of a series of laws to help stimulate the economy after the Great Recession, and the revenue stemming from FATCA was aimed at funding those provisions. It also hoped to prevent tax evasion from US citizens that held assets beyond US territory. Since the United States is one of the few countries in the world to use citizenship-based taxation, all US citizens and Permanent Residents (Green Card Holders) must make a declaration on their worldwide income. Since it was enacted, FATCA provides a regulatory framework for the exchange of the required information from overseas financial institutions to the US government.

CRS

The Common Reporting Standard, or CRS, is a set of financial reporting standards developed and implemented by the Organisation for Economic Cooperation and Development (OECD) in 2014 in response to a G20 request to create a framework for the exchange of information between jurisdictions and financial institutions annually. The CRS guidelines note what type of accounts are subject to the rules, the information to be exchanged, the reporting mechanisms and a set of due diligence procedures that everyone subject to CRS must follow.

What are the FATCA compliance requirements?

What are the obligations under FATCA? There are two parts to compliance, one for American citizens, and the other for entities. As the United States is one of very few countries in the world to practice citizenship-based taxation, they must declare their assets to the IRS even when living abroad, regardless of how much money they make. For US citizens, they must pay fines on any foreign assets that are worth more than $50,000 a year.

Then, what do non-US Foreign Financial Entities (NFFEs) and Foreign Financial Institutions (FFIs) have to do to fulfil the FATCA compliance requirements? The US Internal Revenue Service (IRS) requires foreign banks and financial institutions to reveal the identities of their citizens with accounts in those entities. This procedure involves them disclosing the names, addresses, and taxpayer identification number (which in the United States is their Social Security Number or SSN) and the record of deposits and withdrawals for the year.

If an FFI refuses to comply with FATCA, they will lose access to the United States market and then see 30% of any payments withheld as a tax penalty for noncompliance. While the price to not comply is high, it is also costly for these banks and financial institutions to comply. As a result, many non-US banks decided to stop servicing or limiting the products offered to US citizens for that reason (including HSBC and Deutschebank). It even resulted in closing off the majority of the banking system to American citizens living in Switzerland and only allowing them to have basic accounts, leading to a concerning development for US expats. Those FFIs that will accept US citizen clients have obliged them to fill out a W-9 form with their Social Security Number, so the IRS is aware of foreign assets held by US taxpayers.

Despite FATCA, it is not illegal for US citizen customers to hold offshore accounts. As we have previously noted, you just have to self-declare those accounts because your tax declarations must reflect all global assets.

What are the Common Reporting Standard Guidelines?

Since the CRS is an information-sharing agreement between signatories, it requires financial institutions to determine what jurisdiction serves as an account holder’s tax residence. You are generally a tax resident in the country where you have to pay corporate and income taxes, and every country has different parametres to determine whether you are a tax resident or not. If you bank in a country that is different than where you are legally a tax resident based on the tax residency standards set up by country, the financial institutions will have to exchange information to that jurisdiction. Depending on the type of accounts or financial products you hold, what country you carry out your banking, and where you operate your enterprise, you may be subject to CRS or not. The recommended path is to consult a tax advisor to determine your liability.

The information you most often have to present under CRS from country A to country B is the following:

- Name and Date of Birth of the Reportable Person(s)

- Address

- The Country (or Countries) of Tax Residence

- Account Number and the Account Balance

- Specific payments into the account

If it’s an entity, you would also have to supply the following:

- Place of registration/incorporation

- Type of entity

- If you have a controlling person, you would also need to disclose the kind of controlling person

If you presented FATCA, does that mean you don’t have to comply with CRS?

FATCA and CRS have differences because they are separate sets of regulations. If you are subject to reporting under FATCA and you also have financial products in a CRS country, you would have to ensure your financial statements comply both with the CRS standards in conjunction with the local tax authorities and the IRS.

If you’re looking for compliance for your financial statements, the fiduciary experts at Europe Emirates Group will look at your assets and your circumstances regarding tax residency to make sure you are complying with the relevant authorities. As economic policy around the world aims to fight global tax evasion, you must take steps to protect your assets. Since the deadline for US taxes is 15 April, it’s time for you to think about your US tax return. Are you ready? If so, get started today.

Written by

Darrach Campbell ACSI

Senior Executive, Quality Management Services